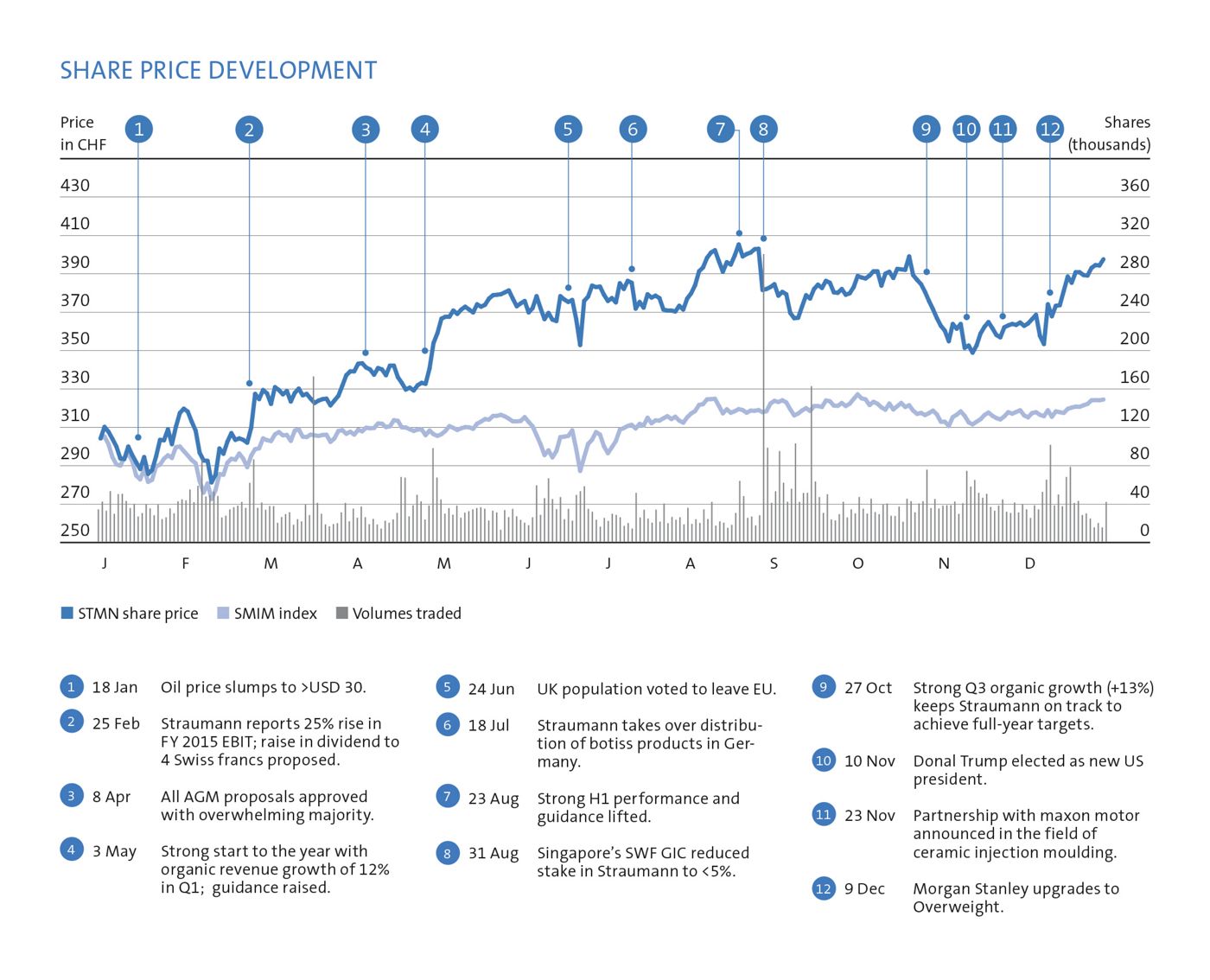

Three factors dented the global stock markets in 2016: the decline in Chinese export demand, the UK’s decision to exit the EU, and the US presidential election, which had the greatest impact. Despite global uncertainty, Wall Street reacted positively and the S&P 500 reached new highs. European stocks fell and finished the year where they began. While firms in Europe are still recovering from the economic crisis, US firms took advantage of low interest rates to acquire other companies and/or to repurchase their own shares in order to stimulate earnings growth.

Swiss interest rates have been negative for almost two years. Government bonds bear negative returns, and private investors have seen no interest on their savings. Although it offers alternative opportunities, the Swiss equity market has also been under pressure and the SMI closed the year 7% lower than it began. The SMIM mid-cap index performed better (+5%) but only half as well as in previous years and considerably lower than the US S&P 500 (+10%).

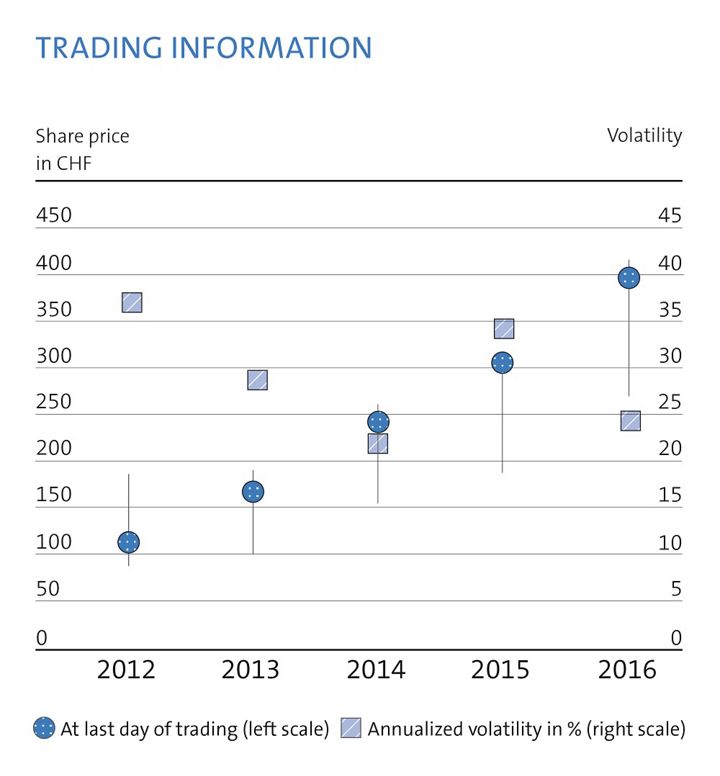

With the share price rising 30%, Straumann ranked fifth in the SMIM and 75th in the Euro Stoxx 600.

The stock price progression was only temporarily interrupted by profit-taking activities and asset rotations after the US election. During this period, active investors shifted investments away from high P/E, defensive stocks (e.g. medical devices) to pharmaceuticals, financial services and infrastructure sectors.

Over the past three years, Straumann has outperformed the SMIM by 112% (37% p.a.), reflecting the change in strategy, market share gains, the replenished product pipeline, and margin expansion. Strong fundamentals have lifted investor confidence considerably. In a poll of 60 investor professionals, 86% said the company’s strategy was convincing.

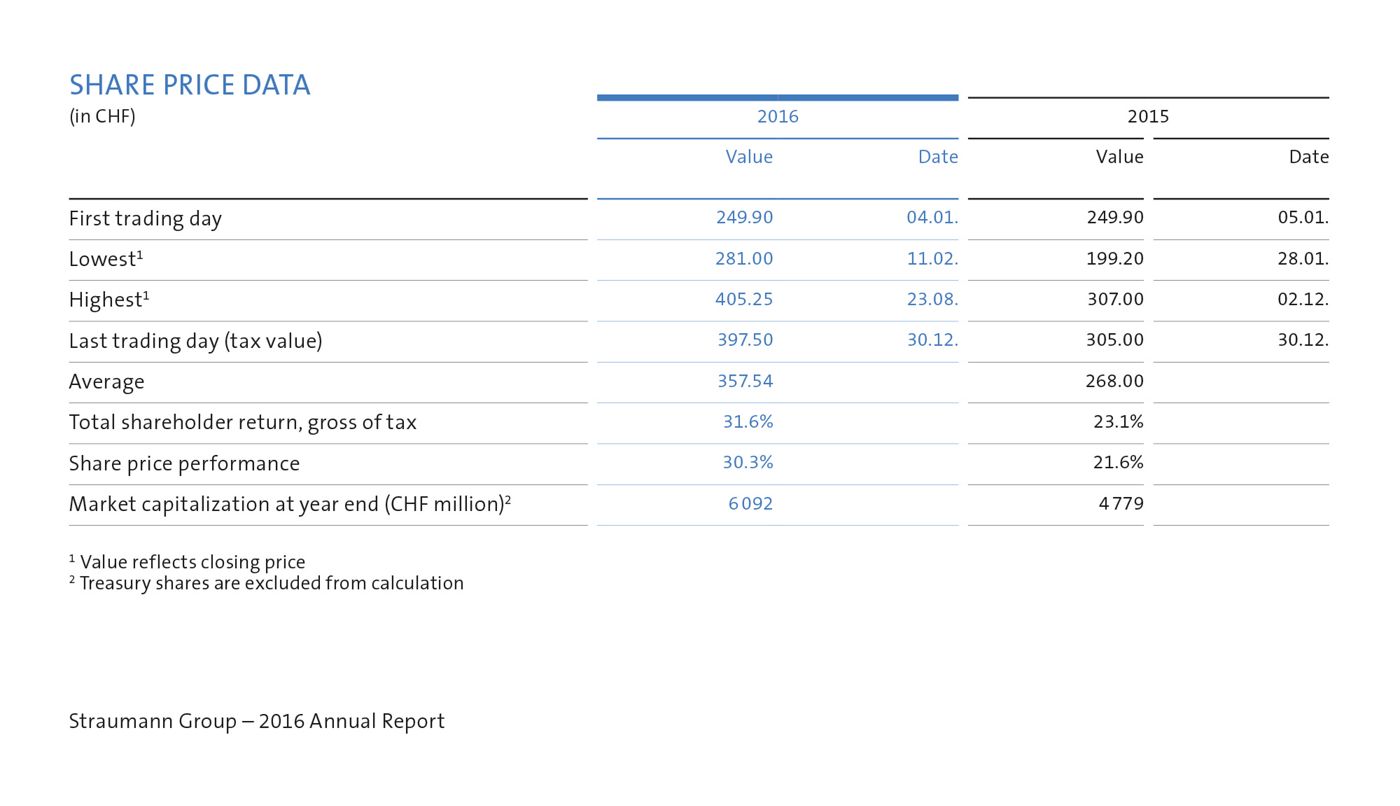

Total pre-tax shareholder return amounted to 145% or CHF 242 per share. The average daily closing price in 2016 ranged from CHF 281 to CHF 405, with the year-end closing price at CHF 397.50. On average, 38 800 Straumann shares were traded daily, which is good in view of the narrow free-float and increase in multilateral trading facilities.